When summing up the current year and writing new year resolutions, we will remember the best travel moments and wish for new ones, because what pampers our souls is the sound of the airplane landing at a new destination. But this article is not about romance; it is about travel industry facts and travel trends we will see next year.

Summary

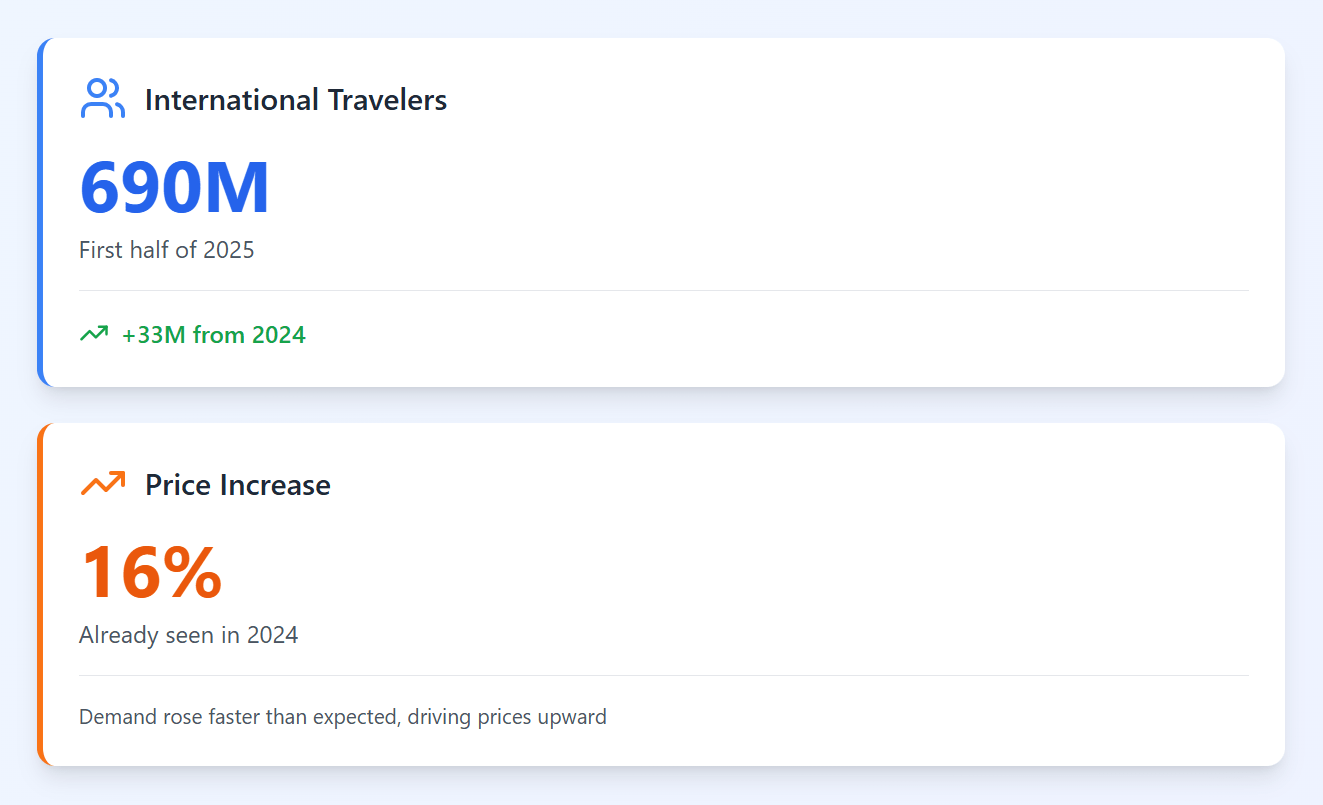

By mid-2025, the global tourism map shifted again. Demand rose faster than expected, and prices followed (we already saw a 16% increase in 2024). According to UN Tourism’s World Tourism Barometer (June 2025), 690 million people traveled internationally in the first half of the year, 33 million more than in 2024. Europe and the Middle East were the top destinations, while Asia-Pacific progressed unevenly due to regulatory differences.

The final recovery of the travel industry is pretty fractured; the year-over-year uneven development is even more obvious. In one region, countries restricted tourism; in another region, countries built tourism megacities. Plus, the UN Tourism Confidence Index flags a significant increase in transport and accommodation costs, the primary challenges in 2025.

2025 Travel and Tourism in Numbers

Global demand

- International arrivals increased by 5% year-over-year (UN Tourism, H1 2025 Barometer).

- The global travel economy is projected to reach $11.7 trillion by the end of 2025 (WTTC Global Economic Impact Report 2025).

- Europe accounted for 54% of all international arrivals (UN Tourism).

- Asia-Pacific returned to 88% of 2019 levels.

- Tourism inflation will drop from 8% to 6.8% but will remain above the pre-pandemic value.

Hotel prices by region

- Africa: -21.1%

- Asia: -18.5%

- Europe: +2.8%

- LATAM: -8.3%

- Middle East: -2.2%

- North America: -4.4%

- Oceania: -8.1%

Air travel

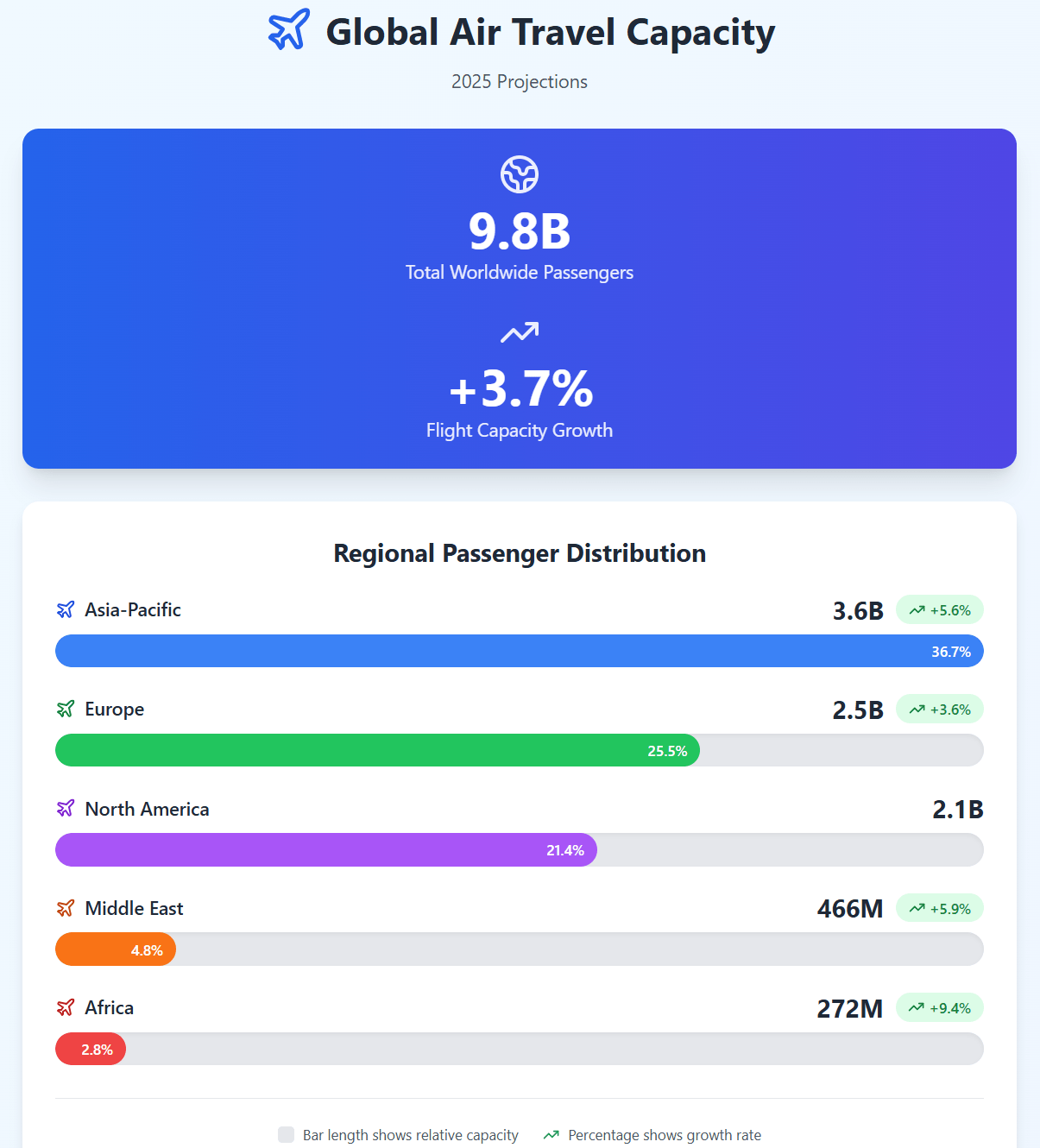

Worldwide flight capacity rose 3.7% and will reach 9.8 billion passengers by the end of the year.

- Africa – 272 million passengers (+9.4%)

- Asia-Pacific – 3.6 billion passengers (+5.6%)

- Europe – 2.5 billion passengers (+3.6%)

- Middle East – 466 million passengers (+5.9%)

- North America – 2.1 billion passengers

Source

Regional performance

Africa

As mentioned in the UN Tourism Regional Commission report for Africa, the region recorded a 9% increase in arrivals during the first six months of 2025, the highest growth rate of any region. The leading destinations were The Gambia (+46%), Morocco (+22%), Ethiopia (7%), and South Africa (+6%).

The region still has a huge tourism potential with its unique nature, rich culture and history, and people’s hospitality. The efforts to promote Africa through arts, film industry, music, gastronomy, dance, etc., definitely bring results, but the region still has so much to offer.

Asia-Pacific

Asia-Pacific arrivals grew 11% in the first half of 2025, yet the region remained 8% below pre-pandemic levels overall—Japan and Vietnam (+21%), the Republic of Korea (+15%).

Japanese philosophy about tourism: they welcome visitors but refuse to sacrifice their heritage for tourism revenue.

China presents the region’s great unknown. The world’s second-largest economy runs a tourism sector decoupled from global flows, only 7%. The explanation? Well, maybe they don’t care as much about tourism as other countries.

This year, we saw Fiji in a different light. Tourism revenue rose 3.8% over the June quarter of 2024, driven by U.S., U.K., and Australian visitors seeking Pacific alternatives to crowded Asian beaches.

Europe

The world’s top destinations are still European countries. Europe welcomed nearly 340 million international tourists in the first half of 2025. It is a 4% increase over 2024, accounting for 54% of all international arrivals globally.

Southern Mediterranean, Western, and Northern Europe saw a moderate 3% growth. Central and Eastern Europe got a +9% increase.

The continent’s dominance persists, but the reception is cooling.

Americas

The Americas recorded 3% growth in the first half of 2025, the slowest among major regions. South America saw +14% growth, while Central America had only 2% increase. The United States, still the world’s largest tourism market, had a 6.3% decrease in inbound travel.

Maui, Hawaii, Atlanta, and New York City have implemented short rental restrictions on Airbnb, which would affect travel experiences in the coming year.

Middle East: The Investment Thesis

The Middle East continues its post-pandemic growth. Saudi Arabia is projected to bring SAR 447.2 billion into the economy by the end of the year and support 7.7 million jobs.

The “problem” with the Middle East, especially Saudi Arabia, is that supply can outpace demand. We see their ambition to capture market share while European destinations are exhausting their potential, and Asian markets continue to face capacity constraints. But they need to stay in their role, a new experience, with no authenticity and less local culture. They are extremely valuable for their futuristic infrastructure and world-class offerings, but they can’t win over travelers who love mountains, Gothic architecture, or Renaissance art.

World’s Top 20 Travel Destinations in 2025

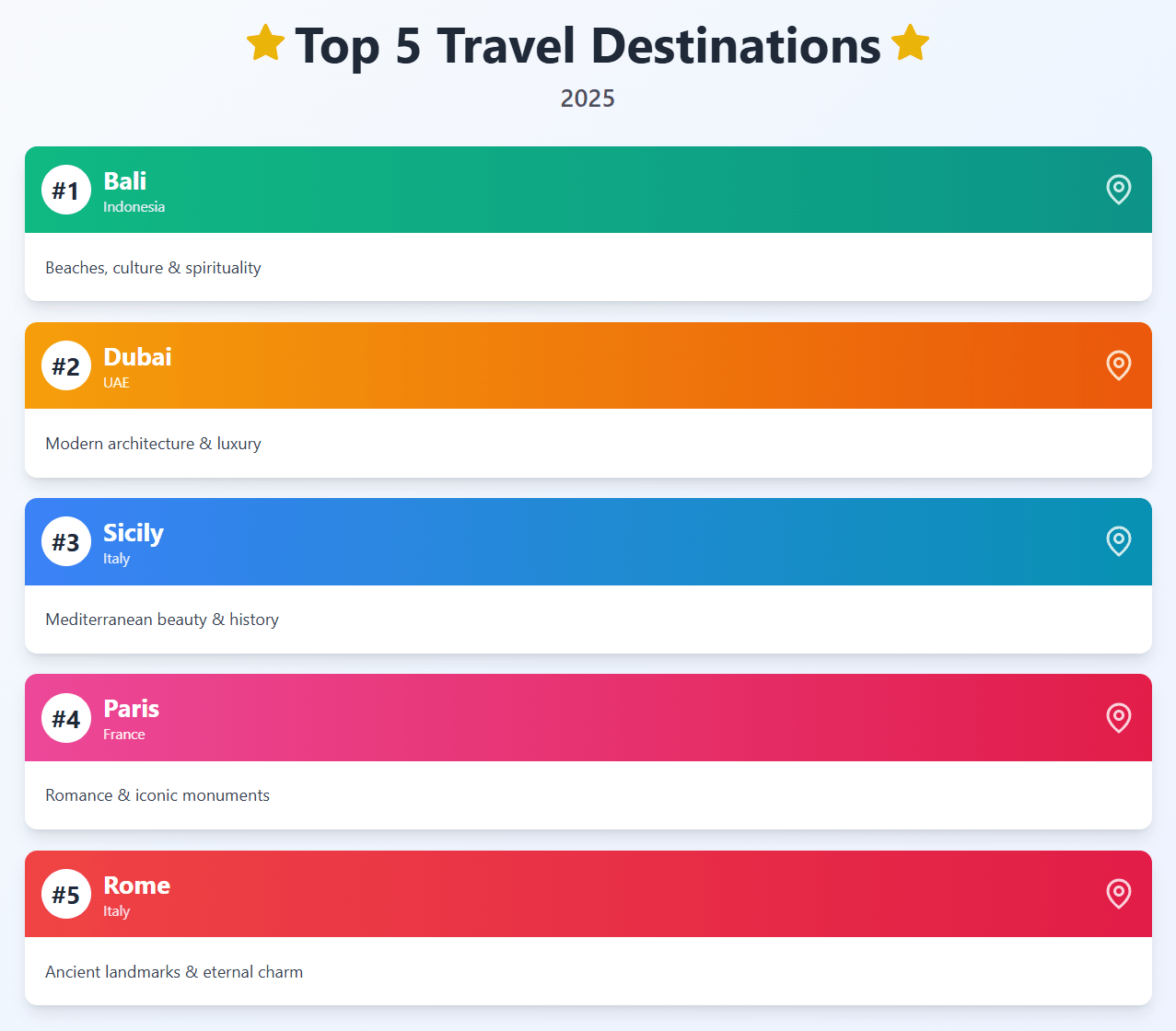

- Bali, Indonesia: It remains a major tropical escape for its stunning beaches, landscapes, and a vibrant cultural center with spiritual and artistic traditions.

- Dubai, UAE: Tourists travel here for the bold contrast between eye-catching modern architecture and rich heritage, all mixed with high-end shopping and global events.

- Sicily, Italy: This island offers a perfect Italian blend: beautiful Mediterranean beaches, incredible food, and history, including spectacular ancient Greek ruins.

- Paris, France: The city maintains its global status as the capital of romance and style, beloved for its iconic monuments, unique ambiance, and urban lifestyle.

- Rome, Italy: The Eternal City is still popular with its iconic ancient landmarks, and because it is Rome. Everyone loves Rome.

- Hanoi, Vietnam: Tourists love the Vietnamese capital for its deep, authentic feel, where French colonial history is mixed with lively street culture and some of the world’s best, affordable street food.

- Marrakech, Morocco: This city offers a sensory overload and a deep dive into culture with its maze-like market streets, Medina, and a gateway to the mountains and desert.

- Crete, Greece: The largest Greek island draws crowds with its combination of gorgeous beaches, important ancient ruins like Knossos, and endless opportunities to experience local Greek life.

- Bangkok, Thailand: Consistently a top spot, the city offers a thrilling 24-hour mix of ancient temples, world-class dining, and a non-stop, vibrant nightlife.

- Hoi An, Vietnam: People find the preserved Ancient Town attractive, thanks to its colorful lanterns and architecture that fuses Chinese, Japanese, and Vietnamese styles.

- Barcelona, Spain: The city is a favorite for its sunny vibe, unique architectural treasures by Gaudí, and the perfect location with access to a Mediterranean beach.

- Cusco, Peru: While the gateway to Machu Picchu, Cusco itself is popular for its rich culture, traditions, and highly-rated food.

- Siem Reap, Cambodia: The city is a top cultural destination simply because it’s home to exploring the incredible, expansive ancient complex of Angkor Wat.

- Lisbon, Portugal: Lisbon has become a favorite for its abundance of sunshine, scenic hilly views, and its compact, welcoming design that makes exploring its charming streets a pleasure.

- Phuket, Thailand: This island keeps drawing visitors with its stunning, picture-perfect beaches, clear waters, and a great balance of world-class resorts and vibrant nightlife.

- New York City, US: The city remains a worldwide magnet thanks to its dazzling skyline, leading cultural centers (like Broadway), and endless diversity across its legendary neighborhoods.

- Majorca, Spain: The largest Balearic Island attracts many tourists with its beautiful beaches, high-quality resorts, and cultural sights, making it a great destination for a relaxing holiday.

- Edinburgh, United Kingdom: Scotland’s capital is loved for its dramatic scenes and its status as a global cultural hub, especially during the annual festivals.

- Kathmandu, Nepal: The capital is a lively cultural center that serves as the starting point for Himalayan adventures, while its ancient temples and squares offer a deep, spiritual experience.

Three more places not to miss in 2026

- Athens Riviera: Replace Santorini with Athens Riviera to avoid the crowds in no less luxurious hotels on the beach.

- Calabria: Replace pricey Amalfi Coast with Calabria and get rewarded with 500 miles of Coast of the Gods.

- Seychelles: Replace the Maldives with Seychelles to avoid crowds, a cliché travel experience, while not sacrificing the unimaginable views. It’s one of the best romantic trip destinations on our list.

Generational Travel Trends in 2025

As always, we love observing how different generations behave while traveling. And the more the travel industry has to offer, the bigger the difference in behavior. Here is what we have noticed this year.

P.S. This is not just an observation. Such information is priceless for industry players to understand where demand is concentrated and how they can target it.

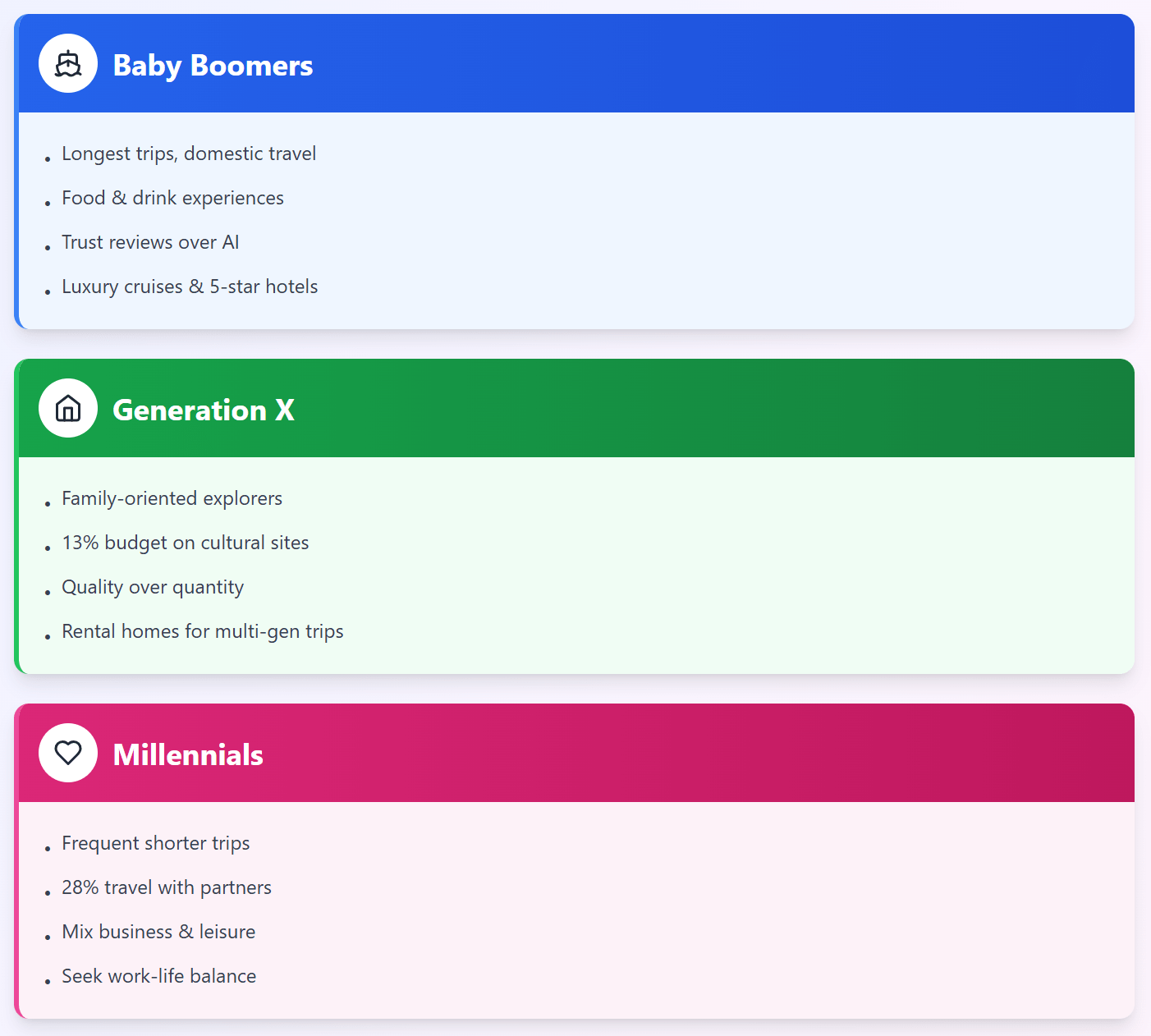

Baby Boomers: Relaxation seekers. They take the longest trips, prioritizing food and drink experiences. Instead of long flights, they prefer domestic travel. They are decisive; they trust reviews than AI when choosing a destination.

This generation loves long cruises, heritage tours, and premium accommodations. They prefer five-star all-inclusive hotels instead of budget stays.

Generation X: The family-oriented explorers. They emphasize quality over quantity, seeking to de-stress and escape. This group is the smallest among all travelers, but they are ready to spend more. Gen X allocates 13% of budgets to excursions, cultural sites, and museums. They use rental homes for multi-generational trips and seek deals, but invest in quality experiences.

This generation is more likely to rent a whole cottage for a family.

Millennials: Romantic and social travelers: They take frequent shorter trips focused on relaxation. Being overloaded with tasks and responsibilities, they just NEED those small vacations to restart. 28% prefer spending their short trips with a partner.

They often combine business and leisure, seeking work-life balance through travel.

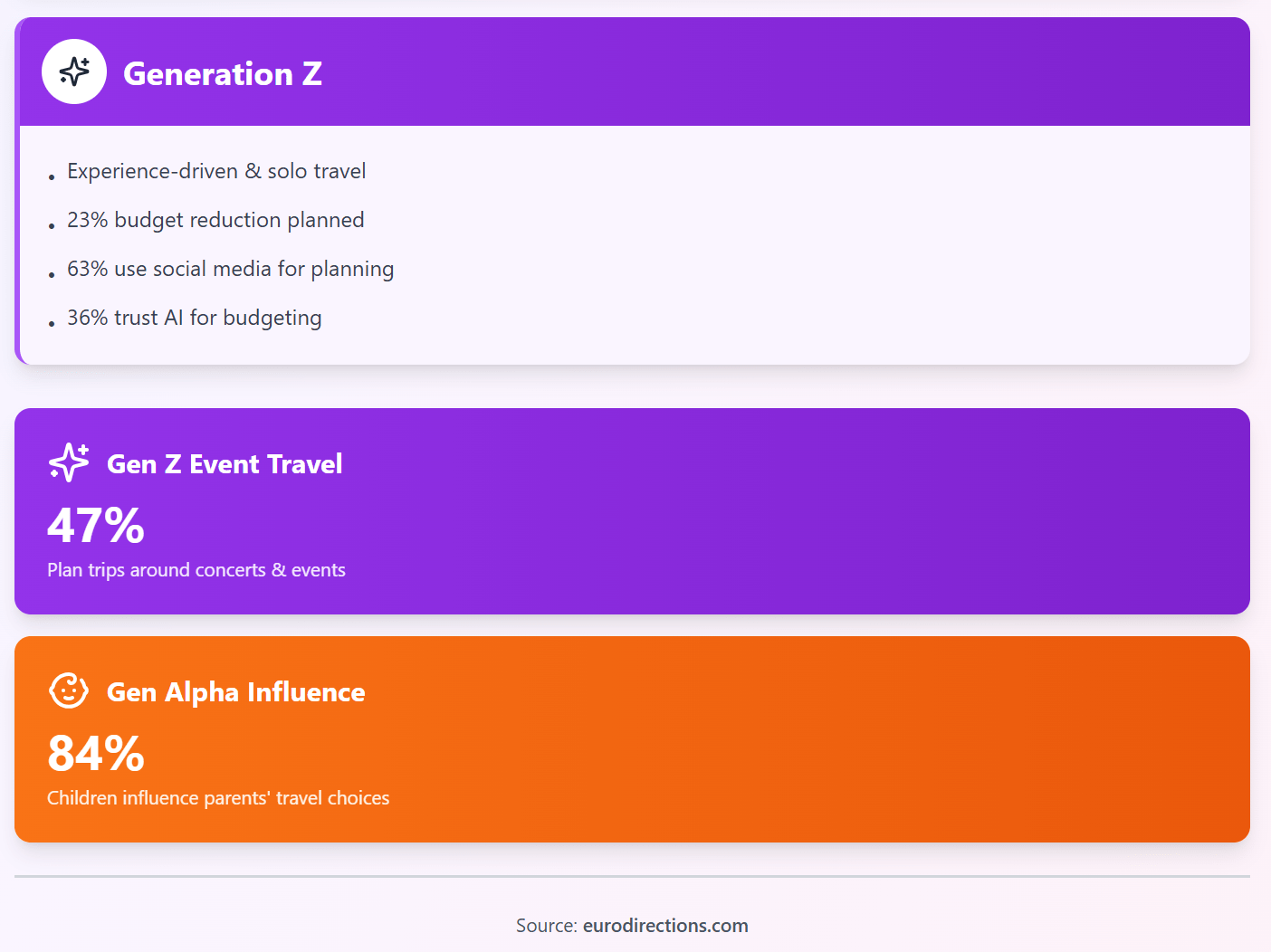

Generation Z: The experience-driven explorers. They prioritize unique, interactive, and social experiences and don’t shy away from traveling solo.

They expect to reduce holiday budgets by 23%, the steepest drop among all generations. This generation prefers alternative stays like glamping, with 63% relying on social media for decisions.

A significant 36% of Gen Z trust AI in budgeting and expense management.

47% of Gen Z plan travel around a central event, like a concert.

P.S. Even though Gen Alpha can’t travel on their own, 84% of Gen Alpha children already influence their parents’ travel choices. As a mom of a Gen Alpha, I ask myself this question too, a little bit differently: “Where can I take my baby to enjoy my vacation too (for an hour, please?).” A beach and an all-inclusive hotel are my choice.

The Overtourism Endgame

I never knew there would be times when travel and tourism would be discussed in a negative light, but here we are, discussing overtourism and travel regulations. For decades, tourism boards operated under a simple philosophy: increase arrivals. Success means growth. Failure means stagnation. But today, governments prioritize their residents’ quality of life over tourism income, and we already feel these effects in tourist taxes and higher prices.

Spain: Ground Zero for Backlash

Spain is the epicenter of anti-tourism resistance. Barcelona announced plans to eliminate all tourist rentals by 2028, the most aggressive housing policy implemented by any major European city.

Valencia increased inspections of tourist apartments by 454% in a single year, which was followed by the closure of 278 illegal residences. The city will start cutting off electricity and water in illegal tourist accommodations.

Catalonia raised its daily tourist tax to €15 as of October 2025, one of the highest in Spain.

The Spanish response reflects a genuine social crisis. When housing becomes unaffordable for residents because it’s more profitable to rent to tourists, when neighborhoods transform into hotel districts, the housing issue becomes inevitable.

Italy: Protecting What Remains

In April 2024, Venice announced a €5 entry fee for day visitors, the first city globally to charge admission to its historic center. They plan to charge €10 in 2026. The city restricted cruise ship access to its historic center after years of protests about massive vessels dwarfing Renaissance architecture. Cinque Terre caps daily walkers on Via dell’Amore at just 400, instead of thousands.

Pompeii, with more than 4 million annual visitors, also implemented visitor management measures to protect archaeological integrity.

Florence banned outdoor dining structures on 50 of its most iconic streets starting in 2026, reclaiming public space from commercial encroachment.

Rome implemented behavioral rules preventing topless tourists, eating messy food around attractions like the Trevi Fountain, and attaching love padlocks to bridges. (I love this law, though.)

Italy’s approach is clear: UNESCO World Heritage sites should be protected, but they can’t be when unlimited tourists visit them. However, as a tourist planning a romantic trip to Italy, reading such news leaves an unpleasant feeling of not being welcome. Do I want to travel somewhere I’m not welcome? I don’t think so.

Netherlands: Amsterdam’s Radical Restructuring

Amsterdam has also joined the army of cities with restrictions, with plans to limit cruise ships to 100 in 2026, before banning them entirely by 2035.

The 2024 “Stay Away” campaign explicitly told certain tourists their business was unwelcome. Deputy Mayor Sofyan Mbarki described it as discouraging travelers from bringing their “nuisance.”

Amsterdam is also limiting new hotel construction and increasing overnight stay taxes.

France: Legal Architecture for Control

Paris solves its housing crisis by reducing short-term rental periods from 120 to 90 nights in certain areas through the “Loi le Meur” law introduced in 2025.

Cannes will restrict cruise ships to vessels carrying more than 3,000 passengers starting January 2026, with a daily cap of 6,000 passengers.

Nice implemented restrictions limiting ships carrying more than 900 passengers by 2025.

Greece: The Revenue Paradox

Greece has the most difficult case. The country faces the most acute tension between economic benefits and overtourism damage. The country is extremely popular during the summer months, and for 2026, it will also set records in revenue. International visitor spending is expected to hit $28 billion in 2025, an 11% increase.

Greece introduced a climate resilience tax of €1.50 to €15 for peak-season accommodations, plus cruise passenger fees up to €20 on Santorini and Mykonos during peak months. The Acropolis operates under permanent visitor caps.

Japan: Cultural Preservation Through Caps

Mount Fuji doubled its entry fee to ¥4,000 ($24.70) for the 2025 climbing season while maintaining a 4,000 daily climber limit on the Yoshida Trail. Night climbing is prohibited, and the trail is closed from 2 p.m. to 3 a.m. daily.

Shizuoka Prefecture now requires climbers to attend safety courses and pass tests, ensuring awareness of risks. You know, not everyone is ready to take classes on vacation, that’s why the number of climbers reduced from 200,000 to 178,000.

Japan’s approach to over-tourism is again philosophical. The country accepts fewer visitors paying higher fees for better-managed experiences.

Latin America: Platform Disruption Response

Together with Brazil, Argentina, and Mexico, Cuba is closing Airbnb to control short-term rentals.

In 2024 and 2025, increased Airbnb bookings led to declines in hotel bookings in Mexico (27%), Buenos Aires (16.2%), and Argentina’s Cuyo region (22.6%).

Latin American countries are reshaping tourism policies to promote the traditional hospitality sector.

Nordic Countries: Environmental Thresholds

Iceland introduced new per-passenger, per-day fees and will accept 80 fewer cruise ship visits in 2026.

Northern latitudes face unique challenges: short tourism seasons concentrate impact, while Arctic and sub-Arctic environments recover slowly from damage.

Search interest in “cooler holidays” rose by 300% year-on-year, driving booking increases to Estonia (+32%), Iceland (+17%), and Norway (+11%). This creates dissonance for tourists and maybe for the Nordic travel sector. But the fact is, Nordic countries have started implementing controls before reaching Mediterranean-level saturation.

Travel Trends 2025: The Psychology of Adaptation

Beyond the core numbers, the travel trends of 2025 reveal sophisticated shifts in traveler psychology, driven by climate adaptation, digital burnout, and the search for meaning.

Coolcations represent a direct response to climate change. Travelers intentionally seek cooler climates as Mediterranean summers become unbearably hot. The region, including Iceland, Norway, Finland, and Finnish Lapland, sees a significant increase during the period of the Northern Lights.

Calmations serve as an antidote to digital burnout and stress. This travel is about tranquility and disconnection, often promoted by tech-free destinations and wellness activities like nature immersion and mindfulness away from any kind of noise. Travelers leave busy cities for peace, prioritizing mental health over sightseeing volume. This is my kind of travel I dream every single day.

Nostalgia Travel appears from change fatigue. Just like Millennials replay retro music over and over again, they love recreating their childhood vacations. We may even see adult summer camps in retro pop-up, where they escape their families. One such unique place is Polly Pocket’s Compact in Westford, Massachusetts, US.

Workations became normalized among Millennials, driven by hybrid work models. This trend combines business travel with leisure, balancing productivity with experience. The distinction between tourism and temporary residence continues to blur. For workations, people look for stable internet, quiet workspaces, and wellness activities.

Agritourism connects travelers with rural life through farm stays and educational workshops. Fueled by rising interest in sustainable tourism and farm-to-table dining, this trend offers a deeper connection to nature and food production systems. People are now more interested in hands-on farm stays, nature retreats, vineyard visits, and laid-back activities in quiet locations.

Sports Tourism has become one of the most popular sectors in tourism. Mega events like FIFA and UEFA drive the sector, but niche sports events are no less important.

Pop-culture Tourism is about how the media influences travel habits. The success of TV shows directly translates into tourism revenue for filming locations. Viral content on TikTok and Instagram also has a huge impact on tourists’ choices. They are actively following influencers and artists and copying not only with style but also with travel destinations.

Slow Tourism and Hyper-local Tourism are other ways to find the inner balance we are losing in digital noise. Travelers spend more time in single locations, actively seeking off-the-beaten-path destinations over conventional hotspots. This segment prioritizes depth over breadth, low-key restaurants and local markets, authentic cuisine, and cozy accommodation.

Trailblazer Hotels transform hospitality by becoming destinations themselves. This year, people searched more for exclusive hotels that go beyond being just a luxurious accommodation option. Through unique design and deep cultural immersion, venues like Les Lumières in Versailles and Jannah Lamu in Kenya position themselves as essential, aspirational parts of the journey, or may even be the first reason people travel.

Noctourism (night tourism) focuses on nocturnal experiences, such as late-night museum tours, after-hours safaris, celestial viewing, bioluminescent beaches, etc. By the way, this year has had the most impressive aurora moments. This trend also redistributes visitor pressure, offering experiences outside of traditional hours.

Baecations are back. Couples are more eager to plan romantic escapes to recover their relationship. Not only have couples without children joined the trend, but families with children have also found travel to be a good way to escape the everyday hustle.

Holiday Romance is back as a reaction to digital dating burnout. People are tired of dating apps and see new opportunities in travel. 79% of Gen Z are disappointed in online dating and look for new connections outside their “natural habitat.” Both solo and group travel are great options.

What will the travel and tourism industry be like in 2026

Tourism recovered. Borders opened. Life resumed. It seems that we have finally returned to the pre-pandemic state, but this narrative is false.

Regulatory frameworks tightened. Prices increase, and technology has changed behavior. Generational preferences diverged. Regional performance varied dramatically.

Most travelers failed to adapt. They approached 2025 travel with 2019 assumptions: book late, expect availability, and reasonable prices.

Next year we will have more restrictions and higher prices, but this doesn’t mean people will stop traveling. We just need to adapt, or better say, we have to adapt.

––

Special article written by Anush Bichakhchyan for eurodirections and traveltrends.info